This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640. If a Malaysian or foreign national knowledge worker resides in the Iskandar.

Individual Income Tax In Malaysia For Expatriates

Overall income that is earned by household members whether in.

. As of 2019 the average income in Malaysia is RM7901. Ali work under real estate company with RM3000 monthly salary. Taxes for Year of Assessment 2021 should be filed by 30 April 2022.

Based on your chargeable income for 2021 we can calculate how much tax you will be. What is the average income in Malaysia. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585.

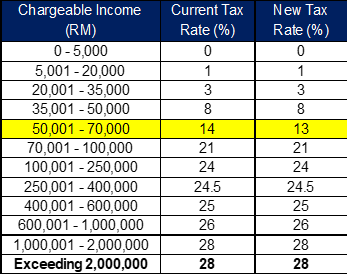

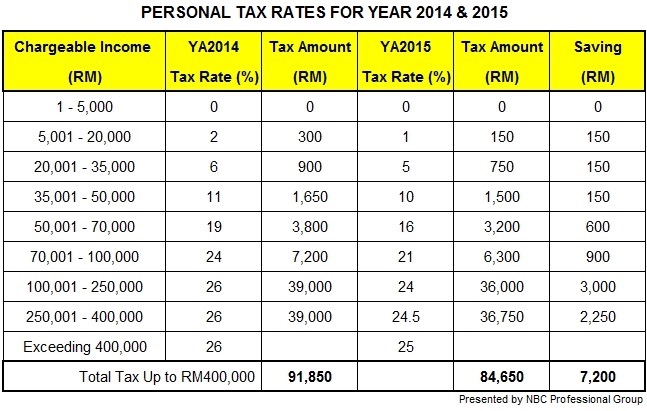

Other income is taxed at a rate of 30. Income tax rates 2022 Malaysia. 13 rows An individual whether tax resident or non-resident in Malaysia is.

Income Tax Rates and Thresholds Annual Tax Rate. SEE WHAT OTHERS ARE READING. Income Tax Rates and Thresholds Annual Tax Rate.

Tax rates on chargeable income of resident individual taxpayers are. Total tax reliefs RM16000. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Personal Tax 2021 Calculation. Malaysias Individual Income Tax Rate is 15. In Malaysia what is the rate of personal income taxation.

Malaysia Non-Residents Income Tax Tables in 2022. Other corporate tax rates include the following. Tax RM A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged.

Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax. In 2016 and 2019 average income recipients in Malaysia was 18 persons. The standard corporate income tax rate in Malaysia is 24.

Resident company with a paid-up capital of RM 25. Any foreigner who has been working in Malaysia for. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The.

Malaysia Personal Income Tax Rates 2022. 13 rows Malaysia Residents Income Tax Tables in 2020. 7 areas in Klang Valley.

Information on Malaysian Income Tax Rates. Our calculation assumes your salary is the same for 2020 and 2021. Non-residents are subject to withholding taxes on certain types of income.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Annual income RM36000. RM9000 for individuals.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Malaysia Budget 2021 Personal Income Tax Goodies

Tax Guide For Expats In Malaysia Expatgo

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

How To Calculate Foreigner S Income Tax In China China Admissions

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Budget Highlight 2021 Taxletter 26 Anc Group

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Asean Regulatory Brief Cit Incentives Pit Changes Export Management Fees Vat On E Commerce And More Asean Business News

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Malaysian Bonus Tax Calculations Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia